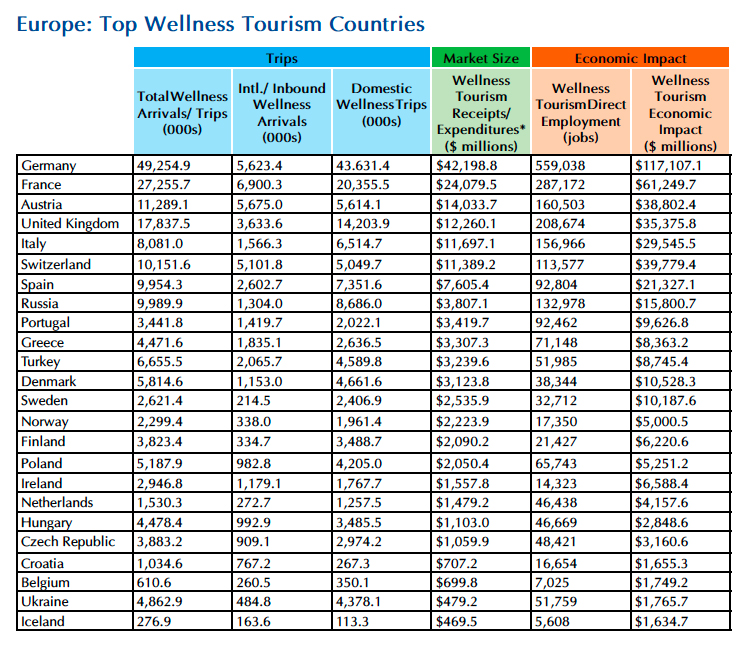

The research, undertaken by SRI International for the GWTC, reveals that Europe is a wellness travel powerhouse: ranking No.1 globally for annual trips taken (203 million) and No.2 for expenditures ($158.4 billion USD or 115.3 € billion).

If wellness tourism is defined as “all travel associated with enhancing one’s personal well-being,” Europeans drive nearly 2 in 5 of all trips taken - and euros spent - in this category every year.

Six of the top ten nations for wellness tourism expenditures are in Europe, ranking in order as: Germany, France, Austria, UK, Italy and Switzerland.

And this well-established European travel market will see a 7.3% annual growth rate through 2017, with developing nations like Russia, Turkey and Poland clocking the fastest growth.

For the full market breakdown for 24 European nations (trips and expenditures, international vs. domestic travel, and wider economic impact), click here:

Susie Ellis, Chairman & CEO of the GWTC presented the findings today at the ITB Berlin Experts Forum on Wellness, and noted: “Europeans are the most sophisticated, experienced wellness- and prevention-focused focused travelers on the planet.

They not only take frequent trips within their own countries and across Europe, they’re also pegged as the largest source market for international wellness travel.

And with so many European tourism boards – from Austria to Slovenia – now smartly promoting their unique offerings, the region will only continue to attract more health-minded travelers from all over the world.”

The “Big Three,” Germany, France and Austria, currently account for over $80 billion USD/58 billion € in wellness tourism spend yearly - or nearly 1 in 5 dollars spent in this global travel segment.

And Germany ranks No. 1 by strong margins for both trips and expenditures in Europe: with 49.3 million trips and $42.2 billion USD (30.72 € billion) in receipts annually – trailing only the U.S. for both trips and spend. In fact, the country drives nearly 1 in 10 wellness tourism dollars spent globally.

And, interestingly, Germany ranks No. 1 among all nations for outbound/international wellness travel (19.4 million trips: more than twice as many as the far more populous No. 2 country, the United States, with its notoriously “passport-averse” population.

If wellness tourism is defined as “all travel associated with enhancing one’s personal well-being,” Europeans drive nearly 2 in 5 of all trips taken - and euros spent - in this category every year.

Six of the top ten nations for wellness tourism expenditures are in Europe, ranking in order as: Germany, France, Austria, UK, Italy and Switzerland.

And this well-established European travel market will see a 7.3% annual growth rate through 2017, with developing nations like Russia, Turkey and Poland clocking the fastest growth.

For the full market breakdown for 24 European nations (trips and expenditures, international vs. domestic travel, and wider economic impact), click here:

Susie Ellis, Chairman & CEO of the GWTC presented the findings today at the ITB Berlin Experts Forum on Wellness, and noted: “Europeans are the most sophisticated, experienced wellness- and prevention-focused focused travelers on the planet.

They not only take frequent trips within their own countries and across Europe, they’re also pegged as the largest source market for international wellness travel.

And with so many European tourism boards – from Austria to Slovenia – now smartly promoting their unique offerings, the region will only continue to attract more health-minded travelers from all over the world.”

The “Big Three,” Germany, France and Austria, currently account for over $80 billion USD/58 billion € in wellness tourism spend yearly - or nearly 1 in 5 dollars spent in this global travel segment.

And Germany ranks No. 1 by strong margins for both trips and expenditures in Europe: with 49.3 million trips and $42.2 billion USD (30.72 € billion) in receipts annually – trailing only the U.S. for both trips and spend. In fact, the country drives nearly 1 in 10 wellness tourism dollars spent globally.

And, interestingly, Germany ranks No. 1 among all nations for outbound/international wellness travel (19.4 million trips: more than twice as many as the far more populous No. 2 country, the United States, with its notoriously “passport-averse” population.

Domestic Trips Dominate – But Less So Than Globally

Worldwide, domestic wellness tourism is much larger than its international equivalent, accounting for 84% of trips.

In Europe, domestic trips are slightly less dominant, at 77%, due to the ease of border-hopping across the continent.

That may be why, after the U.S., 4 of the top 5 nations worldwide for international wellness tourism arrivals are in Europe: No. 2 France drives 6.9 million inbound trips; No. 3 Austria, 5.7 million; No. 4 Germany, 5.6 million; and No. 5 Switzerland, 5.1 million.

And five European nations actually generate more international arrivals than domestic trips: Austria, Switzerland, Ireland, Croatia and Iceland.

But Europe is, of course, also a global domestic wellness tourism leader: 7 of the top 10 – and 13 of the top 20 – nations for domestic expenditures are in Europe.

Germany and the United Kingdom are the standouts: the former ranks No. 1 in the world for domestic wellness tourism expenditures ($19.4 billion, or 14.1 € billion), while the latter ranks No. 3 globally with $6 billion (4.4 € billion).

$225 Billion Market by 2017 - Developing Nations Like Russia, Turkey & Poland Growth Leaders

Europe will see a strong 7.3% annual wellness tourism spend growth from 2012-2017, with the market growing from $158 billion (115.3 € billion) to $225 billion (164 € billion).

Europe’s growth rate is slightly lower than the global average of 9.9%, because it’s already such a large, mature market. And it will be developing nations like Russia, Turkey and Poland that will see the biggest annual, double-digit increases.

But note that current regional leader, Germany, will still add the most trips through 2017 (12.7 million).

The top ten fastest-growing European nations, identified by SRI International based on a combination of annual growth rate and total trips added (listed below), also rank in the top 20 globally for total wellness tourism trips added through 2017.

Top 10 Fastest-Growing European Wellness Tourism Markets: Annual Growth Rate & Trips Added from 2012-2017

Russia 13.1% - 8.5 mil.

Turkey 12.6% - 5.4 mil.

Poland 12.4% - 4.1 mil.

Switzerland 8.9% - 5.4 mil.

Hungary 8.9% - 2.4 mil.

Czech Republic 8.9% - 2.1 mil.

Austria 6.9% - 4.5 mil.

Spain 6.2% - 3.5 mil.

France 5.5% - 8.3 mil.

Germany 4.7% - 12.7 mil.

In Europe, domestic trips are slightly less dominant, at 77%, due to the ease of border-hopping across the continent.

That may be why, after the U.S., 4 of the top 5 nations worldwide for international wellness tourism arrivals are in Europe: No. 2 France drives 6.9 million inbound trips; No. 3 Austria, 5.7 million; No. 4 Germany, 5.6 million; and No. 5 Switzerland, 5.1 million.

And five European nations actually generate more international arrivals than domestic trips: Austria, Switzerland, Ireland, Croatia and Iceland.

But Europe is, of course, also a global domestic wellness tourism leader: 7 of the top 10 – and 13 of the top 20 – nations for domestic expenditures are in Europe.

Germany and the United Kingdom are the standouts: the former ranks No. 1 in the world for domestic wellness tourism expenditures ($19.4 billion, or 14.1 € billion), while the latter ranks No. 3 globally with $6 billion (4.4 € billion).

$225 Billion Market by 2017 - Developing Nations Like Russia, Turkey & Poland Growth Leaders

Europe will see a strong 7.3% annual wellness tourism spend growth from 2012-2017, with the market growing from $158 billion (115.3 € billion) to $225 billion (164 € billion).

Europe’s growth rate is slightly lower than the global average of 9.9%, because it’s already such a large, mature market. And it will be developing nations like Russia, Turkey and Poland that will see the biggest annual, double-digit increases.

But note that current regional leader, Germany, will still add the most trips through 2017 (12.7 million).

The top ten fastest-growing European nations, identified by SRI International based on a combination of annual growth rate and total trips added (listed below), also rank in the top 20 globally for total wellness tourism trips added through 2017.

Top 10 Fastest-Growing European Wellness Tourism Markets: Annual Growth Rate & Trips Added from 2012-2017

Russia 13.1% - 8.5 mil.

Turkey 12.6% - 5.4 mil.

Poland 12.4% - 4.1 mil.

Switzerland 8.9% - 5.4 mil.

Hungary 8.9% - 2.4 mil.

Czech Republic 8.9% - 2.1 mil.

Austria 6.9% - 4.5 mil.

Spain 6.2% - 3.5 mil.

France 5.5% - 8.3 mil.

Germany 4.7% - 12.7 mil.

European Economy & Job Driver: Wellness tourism is responsible for 2.4 million DIRECT jobs across Europe. And because of the widely acknowledged “multiplier” effect that individual industries have on overall economies, this travel segment actually has an estimated impact of $451.7 billion (328.4 € billion) on the wider European economy.

This European breakout is the first of 5 global GWTC reports. Data on the Asian, North American, Latin American and the Middle Eastern/African wellness tourism markets will be released in coming months.

“With more people embracing wellness-focused travel around the world, you could almost say that global tourists are waking up and ‘turning European,’” noted Ellis. “Because Europe has known the very best – and the very longest – the true value of healthy travel experiences that restore and rejuvenate.”

For more information on the “Global Wellness Tourism Economy” report, contact Beth McGroarty: beth@rbicom.com or (+1) 213-300-0107.

This European breakout is the first of 5 global GWTC reports. Data on the Asian, North American, Latin American and the Middle Eastern/African wellness tourism markets will be released in coming months.

“With more people embracing wellness-focused travel around the world, you could almost say that global tourists are waking up and ‘turning European,’” noted Ellis. “Because Europe has known the very best – and the very longest – the true value of healthy travel experiences that restore and rejuvenate.”

For more information on the “Global Wellness Tourism Economy” report, contact Beth McGroarty: beth@rbicom.com or (+1) 213-300-0107.

KEY FINDINGS

No. 1 in Trips: Europe leads the world in the number of wellness tourism trips taken annually (domestic and international combined). If 524 million such trips are taken worldwide each year, Europe represents 39% of the total, or 202.7 million.

No. 2 for Expenditures: The global wellness tourism market is worth $439 billion, and Europe drives 36% of all expenditures ($158.4 billion USD or 115.3 € billion), ranking right behind North America, which grabs 41% of the market.

6 of the top 10 - and 11 of the top 20 - nations for wellness tourism expenditures are in Europe:

Expenditures (in billions) & Global Rank for Expenditures:

Germany - $42.2/30.8€ - No.2

France - $24.1/17.6€ - No.4

Austria - $14/10.2€ - No.5

UK - $12.3/8.9€ - No.7

Italy - $11.7/8.5€ - No.8

Switzerland - $11.4/8.3€ - No.9

Spain - $7.6/5.5€ - No.12

Russia - $3.8/2.8€ - No.17

Portugal - $3.4/2.5€ - No.18

Greece - $3.3/2.4€ - No.19

Turkey - $3.2/2.3€ - No. 20

Annual Trips (domestic + international, in millions)

Germany - 49.2

France - 27.3

UK - 17.8

Austria - 11.3

Switzerland - 10.1

Spain - 9.9

Russia - 9.9

Italy - 8

Turkey - 6.6

Greece - 4.5

Portugal - 3.4

Germany = Regional Leader

No. 2 for Expenditures: The global wellness tourism market is worth $439 billion, and Europe drives 36% of all expenditures ($158.4 billion USD or 115.3 € billion), ranking right behind North America, which grabs 41% of the market.

6 of the top 10 - and 11 of the top 20 - nations for wellness tourism expenditures are in Europe:

Expenditures (in billions) & Global Rank for Expenditures:

Germany - $42.2/30.8€ - No.2

France - $24.1/17.6€ - No.4

Austria - $14/10.2€ - No.5

UK - $12.3/8.9€ - No.7

Italy - $11.7/8.5€ - No.8

Switzerland - $11.4/8.3€ - No.9

Spain - $7.6/5.5€ - No.12

Russia - $3.8/2.8€ - No.17

Portugal - $3.4/2.5€ - No.18

Greece - $3.3/2.4€ - No.19

Turkey - $3.2/2.3€ - No. 20

Annual Trips (domestic + international, in millions)

Germany - 49.2

France - 27.3

UK - 17.8

Austria - 11.3

Switzerland - 10.1

Spain - 9.9

Russia - 9.9

Italy - 8

Turkey - 6.6

Greece - 4.5

Portugal - 3.4

Germany = Regional Leader

![USA : les cent jours qui ébranlent le monde [ABO] USA : les cent jours qui ébranlent le monde [ABO]](https://www.tourmag.com/photo/art/large_16_9/88290190-62549314.jpg?v=1746183261)