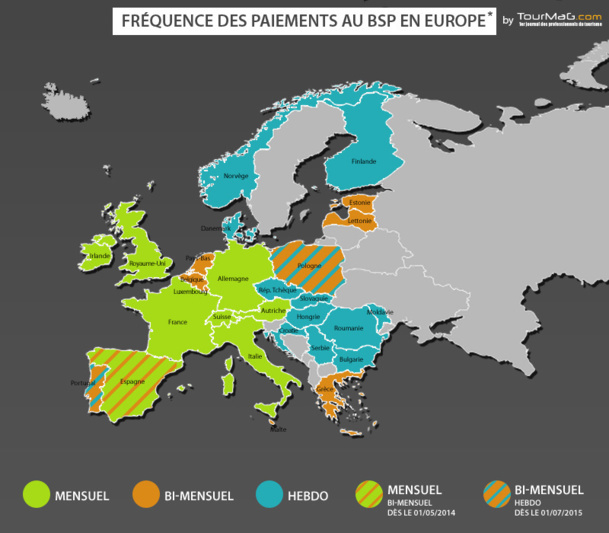

* Note : In models of monthly or bi-monthly payments, agencies can also establish weekly payments. However, the opposite is not possible. IATA criteria also depend on specific countries.

No discussion has started so far, but France should not pass through the cracks of the IATA. Airlines could start, as soon as this year, to launch a debate on the revision of the IATA criteria with the SNAV.

Jean-Pierre Mas, President of the Air Commission of SNAV is not kidding himself. "If the IATA is communicating on the topic, it means that airline companies have a slight idea of what is going on.

But for now, we have not started any discussion, and no agenda is set."

As for the BSP, France is the bad student. In 2013, the country was the second worst payer after Spain, whose accounts have been sealed by the collapse of Orizonia last February.

The amount of unpaid BSP represents almost 0.2% of the transaction amounts, whereas in most other countries, the rate is at less than 0.1%...

Jean-Pierre Mas replies to this by saying: "This rate is not high, and it is not higher than the unpaid rate of direct sales recorded by airlines.”

This is an opinion shared by Michel de Blust, the Secretary General of ECTAA. At the European level, he explains, "the losses due to agency failures rarely exceed 0.1% of the total inflow in the concerned country. A rate this low does not exist in any other economic sector."

In addition, "in a situation of bankruptcy, there is a bank guarantee in favor of the IATA which covers much of the losses," he added.

Jean-Pierre Mas, President of the Air Commission of SNAV is not kidding himself. "If the IATA is communicating on the topic, it means that airline companies have a slight idea of what is going on.

But for now, we have not started any discussion, and no agenda is set."

As for the BSP, France is the bad student. In 2013, the country was the second worst payer after Spain, whose accounts have been sealed by the collapse of Orizonia last February.

The amount of unpaid BSP represents almost 0.2% of the transaction amounts, whereas in most other countries, the rate is at less than 0.1%...

Jean-Pierre Mas replies to this by saying: "This rate is not high, and it is not higher than the unpaid rate of direct sales recorded by airlines.”

This is an opinion shared by Michel de Blust, the Secretary General of ECTAA. At the European level, he explains, "the losses due to agency failures rarely exceed 0.1% of the total inflow in the concerned country. A rate this low does not exist in any other economic sector."

In addition, "in a situation of bankruptcy, there is a bank guarantee in favor of the IATA which covers much of the losses," he added.

"Monthly payments have become an exception in Europe"

Autres articles

-

Limitation des acomptes : vers une augmentation des risques financiers ? 🔑

Limitation des acomptes : vers une augmentation des risques financiers ? 🔑

-

Directive voyages à forfait : "Un déséquilibre évident" entre voyagistes et compagnies aériennes

Directive voyages à forfait : "Un déséquilibre évident" entre voyagistes et compagnies aériennes

-

Limitation des acomptes : le SETO appelle le gouvernement français à se mobiliser

Limitation des acomptes : le SETO appelle le gouvernement français à se mobiliser

-

Développement durable : un nouveau projet européen pour les PME du tourisme

Développement durable : un nouveau projet européen pour les PME du tourisme

-

I. Thomas Cook : 2 ans et 1 pandémie plus tard, que retenir de cette défaillance ?

I. Thomas Cook : 2 ans et 1 pandémie plus tard, que retenir de cette défaillance ?

Meanwhile, airline companies appear determined to move up a gear.

"In Europe,” says Michel de Blust, "either the criteria have been modified, or discussions are in progress."

According to him, there is no doubt that the IATA is seeking to impose weekly payments. “Monthly payments are becoming an exception in Europe, he says. And we are seeing a shift in frequency of monthly payments to bi-monthly and bi-monthly to weekly.”

Already, all new BSP openings begin with weekly payments. Outside the EU, it is also the weekly model that is more frequent.

In China, it goes even further, agencies must checkout 3 times a week.

And in countries where the weekly payment is not yet imposed, many agencies have nevertheless adopted it.

Michel de Blust explains: "When the IATA proposes stricter financial criteria, some agencies do not meet the new criteria.

Therefore they must provide a deposit, which should cover 45 days of sale. This deposit is often deducted from the credit line granted by the bank.

As a result, the increase in the frequency of payments is a way to reduce the deposit amount."

"In Europe,” says Michel de Blust, "either the criteria have been modified, or discussions are in progress."

According to him, there is no doubt that the IATA is seeking to impose weekly payments. “Monthly payments are becoming an exception in Europe, he says. And we are seeing a shift in frequency of monthly payments to bi-monthly and bi-monthly to weekly.”

Already, all new BSP openings begin with weekly payments. Outside the EU, it is also the weekly model that is more frequent.

In China, it goes even further, agencies must checkout 3 times a week.

And in countries where the weekly payment is not yet imposed, many agencies have nevertheless adopted it.

Michel de Blust explains: "When the IATA proposes stricter financial criteria, some agencies do not meet the new criteria.

Therefore they must provide a deposit, which should cover 45 days of sale. This deposit is often deducted from the credit line granted by the bank.

As a result, the increase in the frequency of payments is a way to reduce the deposit amount."

Spain is due to go bi-monthly in May 2014

Evidence that changes are underway, Spain will switch to bi-monthly payments of BSP starting May 1st, 2014, and it will be 3 times per month by 2015.

Poland and Portugal, which are already in the bi-monthly model, will switch to the weekly model starting July 1st, 2015.

"Airline companies demand zero risk, but in business this is impossible,” he says.

"And, in the flying sector, defaults also exist. The bankruptcies in 2012 of Malev and Spanair have put many consumers in difficult situations."

While in France, a procedure like the one launched by SNAV was able to block the BSP funds, for the case of Malev, and in other countries, the customers refund process is still ongoing.

Therefore, distributors demand a guarantee in case of failure.

In France the APST is actively working on the topic. Work is also carried out at the European level.

Still, companies have never been in favor of such a system...

Poland and Portugal, which are already in the bi-monthly model, will switch to the weekly model starting July 1st, 2015.

"Airline companies demand zero risk, but in business this is impossible,” he says.

"And, in the flying sector, defaults also exist. The bankruptcies in 2012 of Malev and Spanair have put many consumers in difficult situations."

While in France, a procedure like the one launched by SNAV was able to block the BSP funds, for the case of Malev, and in other countries, the customers refund process is still ongoing.

Therefore, distributors demand a guarantee in case of failure.

In France the APST is actively working on the topic. Work is also carried out at the European level.

Still, companies have never been in favor of such a system...

![De l’auberge de jeunesse au Generator : toute une histoire [ABO] De l’auberge de jeunesse au Generator : toute une histoire [ABO]](https://www.tourmag.com/photo/art/large_16_9/93247694-65219608.jpg?v=1765984636)