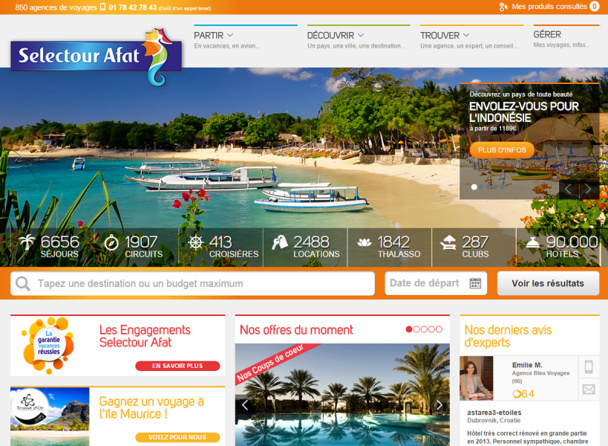

The dynamic package is the growth engine of the Selectour Afat network - DR : Screen Shot Selectour Afat

Air France is once again generous with travel agencies.

The airline company has just announced, during the second encounter of transports at Selectour Afat, a pay rise to the network.

“This new contract is a true change,” explains Jean-Marc Pouchol, Director of Agency Sales at Air France.

First of all, we simplified the rules and criteria by paying right from the first euro of business turnover."

The company is also going to provide better pay on some targeted products: the small and medium companies with the BlueBiz card and leisure, long-haul sales.

This new strategy marks a new revolution according to Patrick Abisset, co-president of the transport and hotel commission.

“It is a true reversal of relations between transporters and distributors. Air France was the first company to completely remove commissions. It is now reintegrating pay on certain products on which we had nothing.”

Only downside: Transavia is not in the list of partner companies. Patrick Abisset would like to integrate it by 2017 in order to avoid a transfer of volume sales towards an operator with which the network does not have a contract.

The airline company has just announced, during the second encounter of transports at Selectour Afat, a pay rise to the network.

“This new contract is a true change,” explains Jean-Marc Pouchol, Director of Agency Sales at Air France.

First of all, we simplified the rules and criteria by paying right from the first euro of business turnover."

The company is also going to provide better pay on some targeted products: the small and medium companies with the BlueBiz card and leisure, long-haul sales.

This new strategy marks a new revolution according to Patrick Abisset, co-president of the transport and hotel commission.

“It is a true reversal of relations between transporters and distributors. Air France was the first company to completely remove commissions. It is now reintegrating pay on certain products on which we had nothing.”

Only downside: Transavia is not in the list of partner companies. Patrick Abisset would like to integrate it by 2017 in order to avoid a transfer of volume sales towards an operator with which the network does not have a contract.

The amount of commission would have been over €10 M in 2014

Autres articles

-

Plongée dans le simulateur de vol d’Air France : immersion dans un cockpit à 10 millions de dollars

Plongée dans le simulateur de vol d’Air France : immersion dans un cockpit à 10 millions de dollars

-

Thaïlande : Air France dévoile une nouvelle destination soleil, cap sur Phuket !

Thaïlande : Air France dévoile une nouvelle destination soleil, cap sur Phuket !

-

Air France : visitez le salon entièrement repensé du terminal 2E de CDG (photos)

Air France : visitez le salon entièrement repensé du terminal 2E de CDG (photos)

-

Air France : Rafael Bence nommé responsable commercial Marchés Loisirs

Air France : Rafael Bence nommé responsable commercial Marchés Loisirs

-

Air France : visitez la luxueuse cabine "La Première" (photos)

Air France : visitez la luxueuse cabine "La Première" (photos)

This new policy of the tricolor company marks a true break in its commercial relations with its partners.

After having penalized the OTAs, it is now awarding the work of physical agencies.

“We believe that the members of Selectour Afat have real prescriptive authority over their clients. Which is why we wish to pay them better,” continues Jean-Marc Pouchol.

Of course, it is impossible to have the details on the amount of these commissions. But they could be superior to 3% once we add the guaranteed pay to that of performance.

In the end, the network should give back in 2014 more than €10 M of “over-commissions” (transports, tourism, and hotel.)

It had given itself the objective to give back 80% to members but was only able to reach 77%, versus 75% in 2013.

Beyond their recommendation power, travel agencies would have an average spending amount higher than OTAs.

“Members of Selectour Afat sell at a higher price than others” rejoices Jacky Cailleau, Travel Distribution Director of the rental company Hertz.

He has reintegrated the network last year and is very satisfied, with transactions at an increase of 18.3%, while other renters regress to 1.3%.

A comment that makes Patrick Abisset rejoice. “Travel agents are finally taking back the control of their profession. The revenue of lost tickets on the web are coming to us and we believe that this is sustainable.”

A phenomenon that can be verified by the numbers, with an increase of 3% of the sales of the BSP France network leading to a business revenue of 1.2 billion euros, tax included.

“We are now the third largest players of BSP France, behind Carlson and Odigeo, but before American Express,” exclaims Patrick Abisset.

After having penalized the OTAs, it is now awarding the work of physical agencies.

“We believe that the members of Selectour Afat have real prescriptive authority over their clients. Which is why we wish to pay them better,” continues Jean-Marc Pouchol.

Of course, it is impossible to have the details on the amount of these commissions. But they could be superior to 3% once we add the guaranteed pay to that of performance.

In the end, the network should give back in 2014 more than €10 M of “over-commissions” (transports, tourism, and hotel.)

It had given itself the objective to give back 80% to members but was only able to reach 77%, versus 75% in 2013.

Beyond their recommendation power, travel agencies would have an average spending amount higher than OTAs.

“Members of Selectour Afat sell at a higher price than others” rejoices Jacky Cailleau, Travel Distribution Director of the rental company Hertz.

He has reintegrated the network last year and is very satisfied, with transactions at an increase of 18.3%, while other renters regress to 1.3%.

A comment that makes Patrick Abisset rejoice. “Travel agents are finally taking back the control of their profession. The revenue of lost tickets on the web are coming to us and we believe that this is sustainable.”

A phenomenon that can be verified by the numbers, with an increase of 3% of the sales of the BSP France network leading to a business revenue of 1.2 billion euros, tax included.

“We are now the third largest players of BSP France, behind Carlson and Odigeo, but before American Express,” exclaims Patrick Abisset.

The dynamic package, an engine of growth

And to better stimulate sales, the network is expecting to request access to the rates of TOs, already available to 25 airline companies.

All of this will enable to support the development of the dynamic package, an engine of growth for the network. The Hip’Réceptifs platform, launched in December 2013, is now used more and more (+47%.)

The hotel sector is progressing as well by 18.2% for a revenue of 68.885 million euros. Five new hoteliers have been referenced: two chains (Choice and Résid’Etudes) and three hotel reservation centers (Euram, Hôtels et Lagons, and Restel).

Enough to largely give a choice to sellers who wish to create their own trip.

And despite this growth of the dynamic package, the network assures not being in competition with partnered tour operators.

“This is not an agression towards TOs. We’re only attempting to respond to clients’ demands,” highlights Patrick Abisset.

Yet, solutions must be found to the slowing down of the sales of producers.

In 2014, tour-operators and cruise operators have only progressed by 1.7%. We’ll leave it to our readers to estimate these numbers, if we take out that of cruise operators…

All of this will enable to support the development of the dynamic package, an engine of growth for the network. The Hip’Réceptifs platform, launched in December 2013, is now used more and more (+47%.)

The hotel sector is progressing as well by 18.2% for a revenue of 68.885 million euros. Five new hoteliers have been referenced: two chains (Choice and Résid’Etudes) and three hotel reservation centers (Euram, Hôtels et Lagons, and Restel).

Enough to largely give a choice to sellers who wish to create their own trip.

And despite this growth of the dynamic package, the network assures not being in competition with partnered tour operators.

“This is not an agression towards TOs. We’re only attempting to respond to clients’ demands,” highlights Patrick Abisset.

Yet, solutions must be found to the slowing down of the sales of producers.

In 2014, tour-operators and cruise operators have only progressed by 1.7%. We’ll leave it to our readers to estimate these numbers, if we take out that of cruise operators…

Selectour Afat network in numbers for 2014

+ 3,8% = tourism activities

+ 1,7% = TO and cruises

+ 18,2% = hotel sector (68,885 millions in revenues)

+ 47% = DMC

+ 1,6% = volume on air transport

+ 3,1% = number of sold tickets (2,924 millions)

- 1,3% = car rentals

- 0,2% = SNCF sales

8 privileged companies = Aegean, Air Austral, Air Europa, Air Transat, Etihad, Qatar, RAM, Qantas. 30 partnered companies. 20 referenced companies.

+ 1,7% = TO and cruises

+ 18,2% = hotel sector (68,885 millions in revenues)

+ 47% = DMC

+ 1,6% = volume on air transport

+ 3,1% = number of sold tickets (2,924 millions)

- 1,3% = car rentals

- 0,2% = SNCF sales

8 privileged companies = Aegean, Air Austral, Air Europa, Air Transat, Etihad, Qatar, RAM, Qantas. 30 partnered companies. 20 referenced companies.

![Lire ou pas ? Le secteur touristique à un rôle à jouer ! [ABO] Lire ou pas ? Le secteur touristique à un rôle à jouer ! [ABO]](https://www.tourmag.com/photo/art/large_16_9/88094660-62395447.jpg?v=1745418480)