Platforms on apartment or house rentals between individuals such as Airbnb, taxi and carpooling services such as Uber and Lyft, airport car rental between individuals such as Flightcar, private jet seat purchase through Freshjets, reservation of a shared working space on Liquidspace; here are just a few examples of players from the sharing economy that are joining the traditional offer for Business travelers.

According to Airbnb's management body 10% of their clientele uses this type of accommodation service for their business travel.

To better position itself in this sector and to reduce obstacles, Airbnb launched, in summer 2014, a micro-website specifically devoted to business travelers.

It enables those whose employer is subscribed to the platform to have the company account charged directly. Uber also provides this option.

According to Airbnb's management body 10% of their clientele uses this type of accommodation service for their business travel.

To better position itself in this sector and to reduce obstacles, Airbnb launched, in summer 2014, a micro-website specifically devoted to business travelers.

It enables those whose employer is subscribed to the platform to have the company account charged directly. Uber also provides this option.

One…or two feet in the door!

Source: airbnb.fr

Autres articles

-

Airbnb : Bientôt une loi contre l'avantage fiscal ?

Airbnb : Bientôt une loi contre l'avantage fiscal ?

-

Comment Booking, Expedia, Airbnb et Trip.com comptent-elles utiliser leurs réserves ?

Comment Booking, Expedia, Airbnb et Trip.com comptent-elles utiliser leurs réserves ?

-

Airbnb prolonge son dispositif "anti-fêtes"

Airbnb prolonge son dispositif "anti-fêtes"

-

Airbnb lance un fonds pour financer 100 idées de logements "incroyables"

Airbnb lance un fonds pour financer 100 idées de logements "incroyables"

-

Airbnb : découvrez la nouvelle catégorie Patrimoine !

Airbnb : découvrez la nouvelle catégorie Patrimoine !

Furthermore, the two companies have concluded a partnership with the business travel management company, Concur, enabling close to 25,000 companies that represent 25 million employees who make professional trips to enjoy the Airbnb and Uber offers.

On top of enabling Airbnb to access the profiles of Concur’s clients and to issue customized recommendations, the standardization of their services inside the corporate space makes transactions and follow-up of travelers easier for the companies.

In the same vein, the two leaders in the sharing economy held, for the first time, their own kiosks during the annual event of the Global Business Travel Association of 2014.

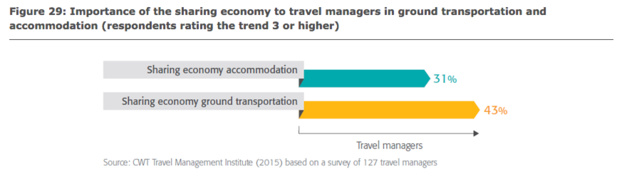

According to the study “Faster, smarter, better?” published by Carlson Wagonlit Travel (CWT), several indicators testify to an increasing usage of the sharing economy in the business travel industry, especially with the removal of barriers for travel managers.

On top of enabling Airbnb to access the profiles of Concur’s clients and to issue customized recommendations, the standardization of their services inside the corporate space makes transactions and follow-up of travelers easier for the companies.

In the same vein, the two leaders in the sharing economy held, for the first time, their own kiosks during the annual event of the Global Business Travel Association of 2014.

According to the study “Faster, smarter, better?” published by Carlson Wagonlit Travel (CWT), several indicators testify to an increasing usage of the sharing economy in the business travel industry, especially with the removal of barriers for travel managers.

A significant weight

According to the CWT survey conducted with 127 travel managers, 43% of them believe that the trend of the sharing economy is important for their sector in terms of ground transportation, and 31% find it important in terms of sharing economy accommodations. (see graph 1.)

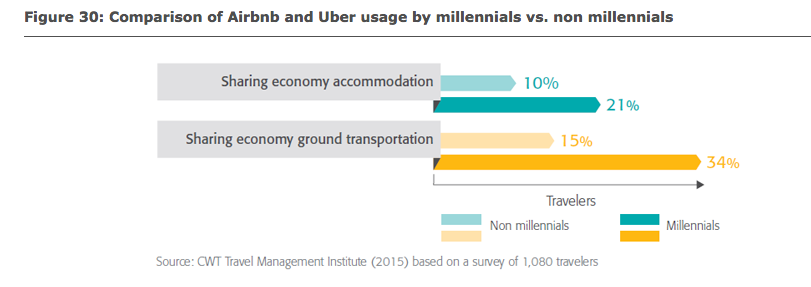

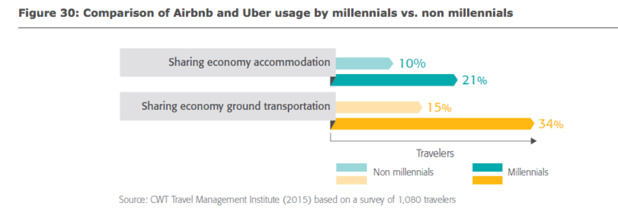

A second survey carried by CWT towards 1080 travelers reveals, unsurprisingly, that millennials (people born between 1980 and 2000) are more inclined to use such services for their business trips (see graph 2.)

More than one third of millennials use the services of Uber during their professional trips (15% amongst non-millennials), and 20% choose Airbnb, versus 10% for travelers of other generations.

More than one third of millennials use the services of Uber during their professional trips (15% amongst non-millennials), and 20% choose Airbnb, versus 10% for travelers of other generations.

Numbers on the rise

Data from Certify, a company that offers online solutions on expense management, reveals some trends on the usage of services from the sharing economy by business travelers during the second trimester of 2015.

By analyzing the expense reports of Certify’s clients, of companies located all over the world, we can draw a few conclusions:

- For the first time, business travelers opt more for Uber (55%) than traditional taxis (43%);

- between the first and second trimester of 2015, the number of Airbnb receipts issued by business travelers grew by 143%;

- the stays of business travelers tend to be longer when they choose Airbnb: 3.8 nights versus 2.1 in a hotel.

By analyzing the expense reports of Certify’s clients, of companies located all over the world, we can draw a few conclusions:

- For the first time, business travelers opt more for Uber (55%) than traditional taxis (43%);

- between the first and second trimester of 2015, the number of Airbnb receipts issued by business travelers grew by 143%;

- the stays of business travelers tend to be longer when they choose Airbnb: 3.8 nights versus 2.1 in a hotel.

Bold and winning partnerships

More and more players of the tourism industry are allying with these new rising stars.

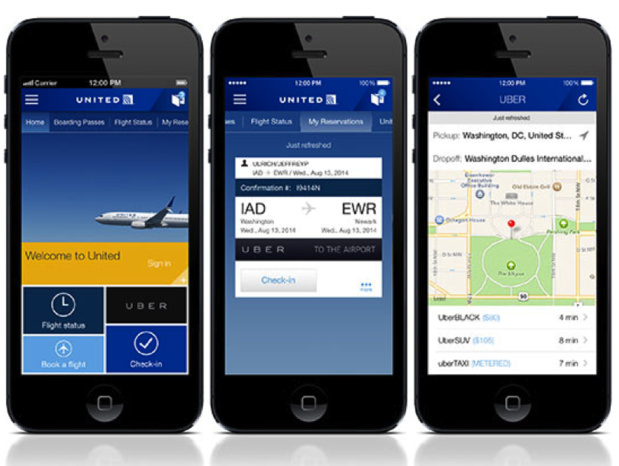

The credit card company American Express partnered with Uber for its frequent flyer program. The latter also holds partnerships with many hotels, including the W of Seattle or the chain Hyatt, that features it in its mobile application. This is also the case of the airline company, United.

The credit card company American Express partnered with Uber for its frequent flyer program. The latter also holds partnerships with many hotels, including the W of Seattle or the chain Hyatt, that features it in its mobile application. This is also the case of the airline company, United.

Source: united.com

The airline company KLM and Airbnb join forces

Now, the transporter’s website displays Airbnb’s offers based on the destination chosen by the visitor. A rather bold partnership connects the management body of the San Francisco destination to Airbnb.

Specifically, San Francisco Travel hopes to promote tourism in local neighborhoods and businesses thanks to Airbnb, while promoting its accommodation offer.

Within the realm of this collaboration, Airbnb is also in contact with events organizers to meet the demand of accommodations for large conventions.

Now, the transporter’s website displays Airbnb’s offers based on the destination chosen by the visitor. A rather bold partnership connects the management body of the San Francisco destination to Airbnb.

Specifically, San Francisco Travel hopes to promote tourism in local neighborhoods and businesses thanks to Airbnb, while promoting its accommodation offer.

Within the realm of this collaboration, Airbnb is also in contact with events organizers to meet the demand of accommodations for large conventions.

Source : airbnb.klm.com

Risks and advantages

While this new offer responds to a demand, particularly in terms of costs, a different experience, and friendliness through the usage of mobile technology, some disadvantages or risks are also noted.

One of the main obstacle to a stronger increase of the usage of the sharing economy by business travelers is safety. Between 27 and 29% of travelers surveyed by CWT, who used Airbnb or Uber during their business trip, believe that risks tied to safety (insurances, frauds, etc.) are higher than in the traditional offer.

This worry is felt even more strongly by travel managers (41 to 43%.)

Still, the companies concerned are working hard to lessen this perception by giving recommendations to users in order to avoid frauds.

They also strongly encourage clients to write comments online to maintain a self-regulation system. The legalization of these offers on a growing number of markets should also appease users.

One of the main obstacle to a stronger increase of the usage of the sharing economy by business travelers is safety. Between 27 and 29% of travelers surveyed by CWT, who used Airbnb or Uber during their business trip, believe that risks tied to safety (insurances, frauds, etc.) are higher than in the traditional offer.

This worry is felt even more strongly by travel managers (41 to 43%.)

Still, the companies concerned are working hard to lessen this perception by giving recommendations to users in order to avoid frauds.

They also strongly encourage clients to write comments online to maintain a self-regulation system. The legalization of these offers on a growing number of markets should also appease users.

Not for everyone

Of course, what the sharing economy has to offer does not suit all business travelers. Most prefer services, stability, safety, or even the benefits earned by frequent customer programs offered in the hotel sector.

But the sharing economy is gaining ground, and traditional providers must focus on their strengths and keep a close eye on this growing type of offer.

Tourism Intelligence Network, Transat Chair in Tourism: AIRBNB ET UBER À L’ASSAUT DU TOURISME D’AFFAIRES

But the sharing economy is gaining ground, and traditional providers must focus on their strengths and keep a close eye on this growing type of offer.

Tourism Intelligence Network, Transat Chair in Tourism: AIRBNB ET UBER À L’ASSAUT DU TOURISME D’AFFAIRES

Source(s)

Alba, Davey. « Business travel is worth $300B – and Airbnb wants its share », Wired, 20 juillet 2015.

Alderton, Matt. « Airbnb, San Francisco form innovative ‘Destination Promotion Partnership’ », Successful Meetings, 23 juillet 2015.

Certify. « Certify Releases Q2 2015 Report on Business Expense Trends », communiqué de presse, 16 juillet 2015.

Certify. « Room for More: Business Travelers Embrace the Sharing Economy », 2e trimestre 2015.

CWT Travel Management Institute. « Faster, smarter, better? », Carlson Wagonlit Travel, 2015.

Forbes, Sophie. « The sharing economy is transforming business travel. Here’s how », Yahoo Travel, 27 juillet 2015.

Gill, Rob. « Analysis: Sharing economy and business travel », Buying Business Travel, 20 octobre 2014.

KLM. « KLM and Airbnb Partnership Kicks Off », communiqué de presse, 10 décembre 2014.

Trejos, Nancy. « Business travelers embrace the sharing economy », USA Today, 19 juillet 2015.

Vivion, Nick. « The sharing economy begins assault on business travel », Tnooz, 30 juillet 2014.

Williamson, Lauren. « Airbnb plans to review business travel with the sharing economy », Fast Company Content Studios, no 2, Fall 2014.

Winkler, Rolfe et Douglas MacMillan. « The secret math of Airbnb’s $24 Billion valuation », The Wall Street Journal, 17 juin 2015.

Alba, Davey. « Business travel is worth $300B – and Airbnb wants its share », Wired, 20 juillet 2015.

Alderton, Matt. « Airbnb, San Francisco form innovative ‘Destination Promotion Partnership’ », Successful Meetings, 23 juillet 2015.

Certify. « Certify Releases Q2 2015 Report on Business Expense Trends », communiqué de presse, 16 juillet 2015.

Certify. « Room for More: Business Travelers Embrace the Sharing Economy », 2e trimestre 2015.

CWT Travel Management Institute. « Faster, smarter, better? », Carlson Wagonlit Travel, 2015.

Forbes, Sophie. « The sharing economy is transforming business travel. Here’s how », Yahoo Travel, 27 juillet 2015.

Gill, Rob. « Analysis: Sharing economy and business travel », Buying Business Travel, 20 octobre 2014.

KLM. « KLM and Airbnb Partnership Kicks Off », communiqué de presse, 10 décembre 2014.

Trejos, Nancy. « Business travelers embrace the sharing economy », USA Today, 19 juillet 2015.

Vivion, Nick. « The sharing economy begins assault on business travel », Tnooz, 30 juillet 2014.

Williamson, Lauren. « Airbnb plans to review business travel with the sharing economy », Fast Company Content Studios, no 2, Fall 2014.

Winkler, Rolfe et Douglas MacMillan. « The secret math of Airbnb’s $24 Billion valuation », The Wall Street Journal, 17 juin 2015.

![Tourisme : où sont passés les Chinois ? [ABO] Tourisme : où sont passés les Chinois ? [ABO]](https://www.tourmag.com/photo/art/large_16_9/87929923-62307593.jpg?v=1744721842)